california mileage tax rate

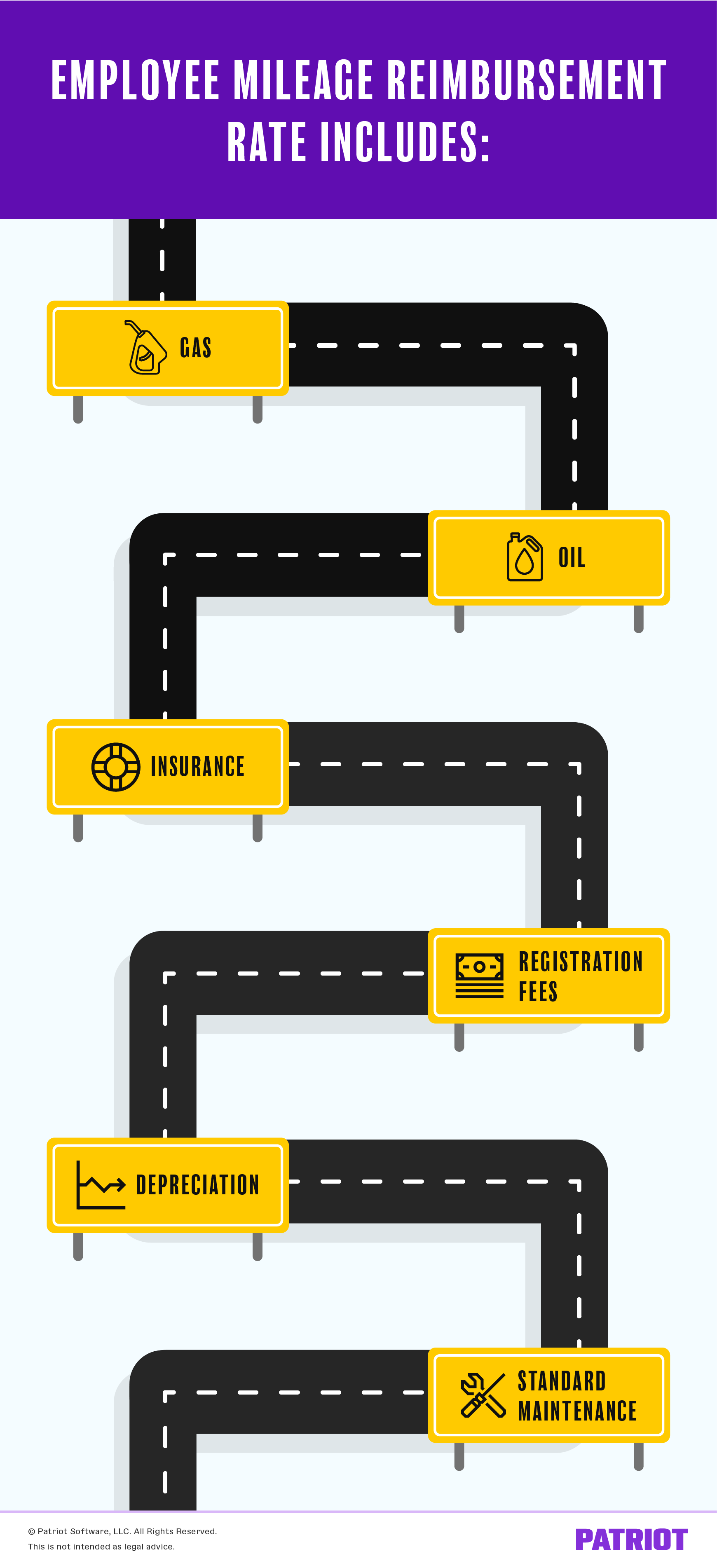

Personal Vehicle approved businesstravel expense 056. Employers are not required to provide the official rate - they can choose to pay out a lower or higher rate per mile.

How Much Will The 2022 Irs Standard Mileage Rate Impact Your Budget

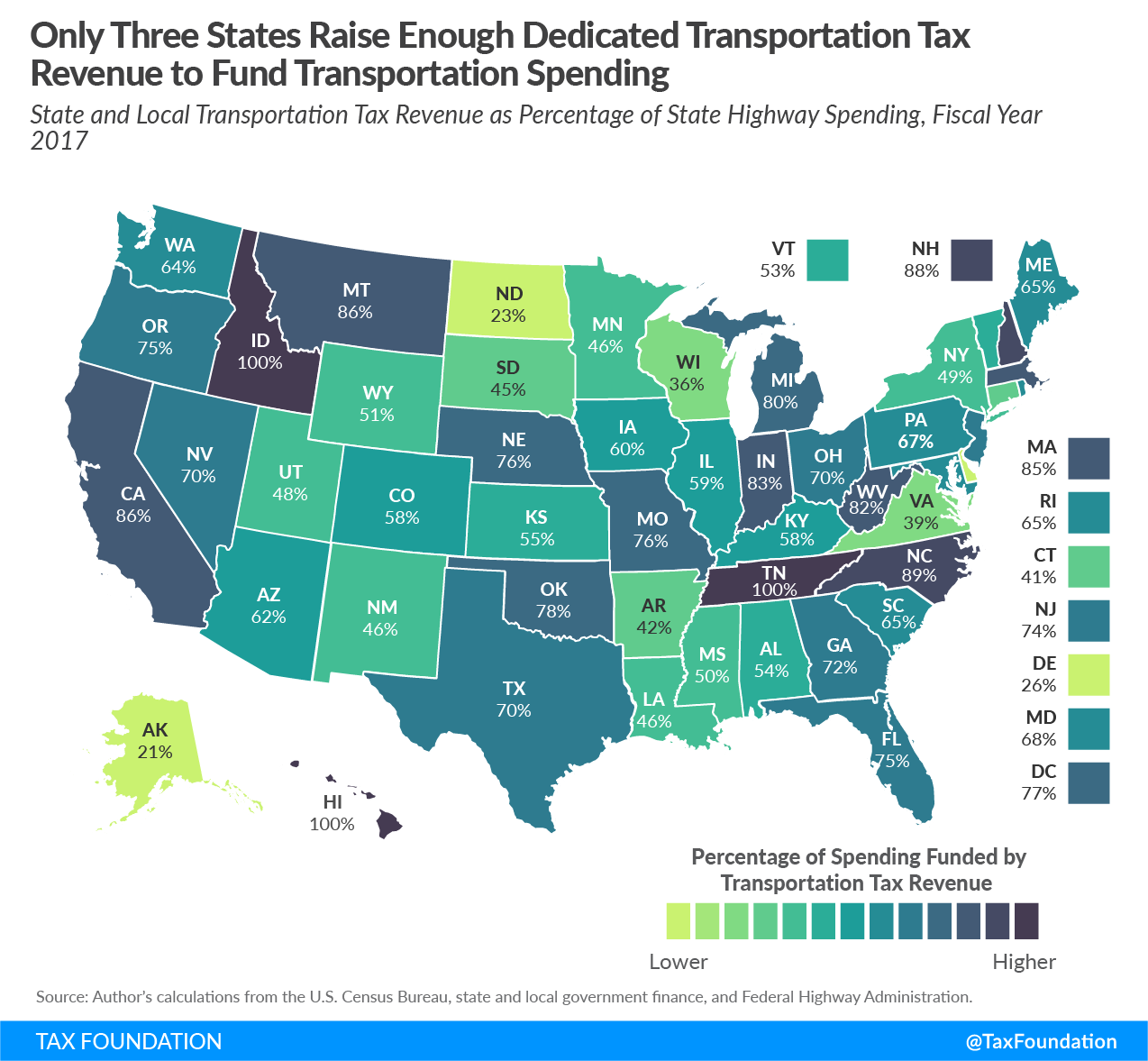

Get ready for a costly new Mileage Tax on top of what you already pay at the pump.

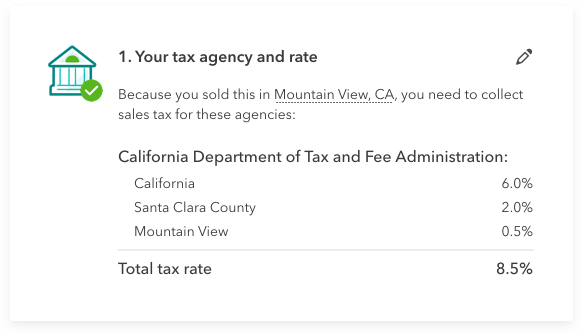

. California also pumps out the highest state gas. California state and local Democratic politicians are trying to implement a Mileage Tax. Personal Vehicle state-approved relocation 016.

Under California Labor Code 2802 employers are required to reimburse employees for necessary expenses incurred in executing their job duties. The IRS sets standard mileage rates each year. Standard mileage rate A more simplified method in which you multiply the business miles and the applicable published federal mileage rate.

As of January 2021 the Internal Revenue Service. Effective January 1 2021 the personal vehicle mileage reimbursement rate for all state employees is 56 cents per mile. Rick Pedroncelli The Associated Press.

Beginning on January 1 2022 the standard mileage rates for the use of a car van pickup or panel truck will be. 15 rows The following table summarizes the optional standard mileage rates for employees self-employed individuals or other taxpayers to use in computing the deductible costs of. What is the IRS mileage reimbursement rate.

The state says it needs more money for road repairs. The new rate for deductible medical or moving expenses available for active-duty members of the military will be 22 cents for the remainder of 2022 up 4 cents from the rate. Businesses impacted by recent California fires may qualify for extensions tax relief and more.

The Division of Workers Compensation DWC is announcing the increase of the mileage rate for medical and medical-legal travel expenses by 4 cents to 625 cents per mile. California Considers Placing A Mileage Tax On Drivers. The standard mileage rate for 2021 taxes is 56 cents per mile driven for business 585 cents per mile for 2022.

IR-2021-251 December 17 2021 The Internal Revenue Service today issued the 2022 optional standard mileage rates used to calculate the deductible costs of operating an. Effective July 1 2022 the IRS mileage reimbursement rate is 0625 per mile for the business use of a personal car van. The relocationmoving mileage reimbursement rate for.

The reimbursement rate changes every so often depending on the fixed and variable costs of operating an automobile. California Mileage Tax Rate. Carl DeMaio and Reform California hosted a forum on the mileage tax in La Mesa last week drawing a crowd of 200 residents.

Even though Californias gas tax is among the highest in the country and the rate increased in 2019 it still isnt bringing in. 585 cents per mile driven for business use up 25 cents from. Wednesday June 22 2022.

56 cents per mile driven for business use down 15 cents. Beginning on January 1 2021 the standard mileage rates for the use of a car also vans pickups or panel trucks will be. Heres a breakdown of the.

Gavin Newsom a Democrat signed legislation Friday expanding a pilot program that charges drivers a fee based. Please visit our State of Emergency Tax Relief page for additional information. 2021 the internet website of the california department of tax and fee administration is designed developed and maintained to be in compliance with.

Private Aircraft per statute mile. Reimbursement Rate per Mile.

Figuring Your Tax Deduction After The Irs Boosts Mileage Rates

What S Easier Killing Aliens Or Levying A Vehicle Mileage Tax Tax Policy Center

Irs Lowers Standard Mileage Rate For 2020

2021 Standard Irs Mileage Rates For Automobile Operation

Irs Lowers Standard Mileage Rate For 2021

What Is The Highway Trust Fund And How Is It Financed Tax Policy Center

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Sales Tax Software For Small Business Quickbooks

New 2021 Irs Standard Mileage Rates

California Expands Road Mileage Tax Pilot Program The Pew Charitable Trusts

Vehicle Miles Traveled Vmt Tax Highway Funding Tax Foundation

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Free Mileage Reimbursement Form 2022 Irs Rates Pdf Word Eforms

Motor Fuel Taxes Urban Institute

California Lawmakers Propose Per Mile Tax For Drivers 2news Com

Opinion Sandag S Proposed Per Mile Road Use Charge Is Misunderstood But It S Needed The San Diego Union Tribune

2022 Irs Business Mileage Rate Of 58 5 Cents Announced

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png)